SIALKOT, Feb 12: The Securities and Exchange Commission of Pakistan (SECP) and Central Depository Company (CDC) on Saturday jointly organized the first of five roadshows here with a view to attracting investors from small cities to the capital market.

The awareness programme, first of its kind in the history of capital market, will also be held in Faisalabad, Multan, Peshawar and Quetta.

SECP Chairman Dr Tariq Hassan, accompanied by CDC Chairman Mohammad Basher Janmohammed and CDC CEO Hanif Jakhura, inaugurated the roadshow aimed at educating potential investors of the capital market. Acting president, Sialkot Chamber of Commerce and Industry (SCCI), Shafiq ur Rehman, was also present.

Mr Janmohammed said that CDC's policies were in conformity with SECP's vision to educate small shareholders about the capital market. He praised the privatization policy of the government and reforms initiated by the SECP.

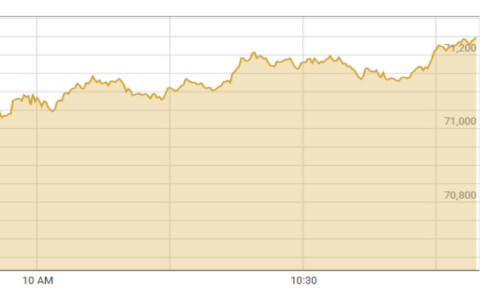

Mr Jakhura said the SECP and CDC had joined hands to pioneer this series of roadshows to expand investors' base which has seen impressive rallies in the last few years. He said that CDC had always kept its focus on the development of capital market and the idea of roadshows is to educate small investors about the capital market, attract people from small centres to venture into the lucrative stock exchanges and provide a platform to the investors to raise their concerns and remove apprehensions.

He informed the participants that CDC was an infrastructure company of the capital market and offered unmatchable benefits of instant shares credit, greater liquidity, stamp duty and postage cost savings, reduced workload and costs for capital market players, quick service and convenient accommodation of huge volume issues.

Mr Jakhura further said that CDC would be providing its investors accounts services from across the country shortly through banks. He said the company had planed to offer these services from middle-eastern countries as well in near future.

He said that performance of the mutual fund industry has shown a significant improvement in the last three years. The net assets went up by 300 per cent from Rs25 billion in FY2002 to Rs97 billion in FY2004. He said the NAV of the mutual fund industry relating to the outstanding stock of NSS instruments had risen from three per cent in FY2002 to 10 per cent in FY2004. The NSS traditionally has been a favoured option for savings. He said that the recent years had not only seen the revival of mutual funds industry in Pakistan, but also the activity had shifted from the public sector to the private sector with open-ended mutual funds having more attractive as compared to closed-end mutual funds.

Dear visitor, the comments section is undergoing an overhaul and will return soon.