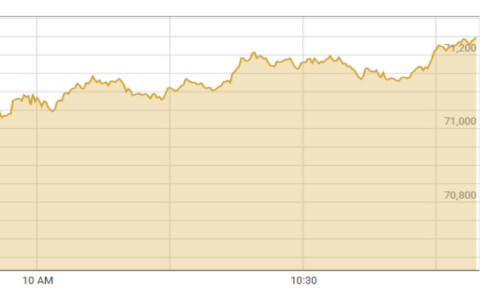

LONDON, Aug 8: Gold prices drifted down in London on Monday, tracking range-bound currency markets, although analysts said funds had scope to buy more. Spot gold was at $436.60/437.40 an ounce, down modestly from New York’s late quote on Friday at $437.60/438.30.

Prices have gained some 4.5 per cent since their low point in mid-July, culminating in a five-week high at $439.10 late last week. Alan Wiliamson of HSBC Bank said the move was all the more impressive given relatively light fund buying over the past month.

Data released on Friday showed a small increase in the net long speculative position in New York gold futures in the week to August 2. It rose to 10 million ounces from 8.3 million. This was the first increase in the net long position in five weeks and still leaves the fund position below the 12-month average of 11.4 million ounces, Williamson said in a report.

He added this should ensure the recent gains were more sustainable, although gold’s performance would remain tightly linked to the euro/dollar. Traders said business remained very subdued due to thin August trade.

The euro hit a two-month high around $1.2400 last week, but was slightly down at $1.2384 on Monday.

Financial markets are turning their attention to interest rates policy in the United States. The Federal Reserve is expected to deliver its 10th straight 25 basis point increase in its funds rate at a meeting on Tuesday, taking it to 3.5 per cent.

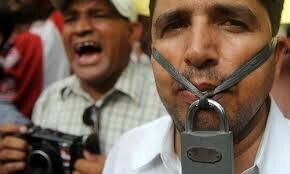

Gold was showing little reaction to a strike by some 100,000 South African gold miners in the country’s first industry-wide strike in 18 years to demand higher wages. A period of consolidation around $430-40 would help build a base for gold to push towards $445-50, he said.

Gold peaked at $446.70 in March and has tried and failed three times this year to climb back to a 16-1/2-year peak scored late in 2004 at $456.75.

Platinum lost further ground as a wave of fund buying subsided, dipping as low as $897 — some two per cent off last Thursday’s 15-month peak. Spot was last at $900.00/903.00 an ounce, down from New York’s $908.00/911.00.—Reuters

Dear visitor, the comments section is undergoing an overhaul and will return soon.